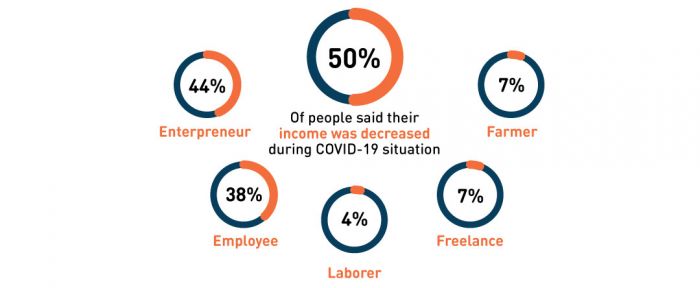

Covid-19 pandemic have impacted many sectors and industries, and it was resulting decrease of income for several people.

On the other hand, daily needs increase because family members do more activities at home and work from home, which means an increase in expenditure for household needs, particularly food. As many as 27% of residents who said it came from residents who experienced a decrease in income.

To keep fulfilling daily needs, people with decreased income were could using installment or credit. It was also supported by the government by issuing BI (Indonesia Central Bank) policy to lower credit card interest rates effective since May 2020.

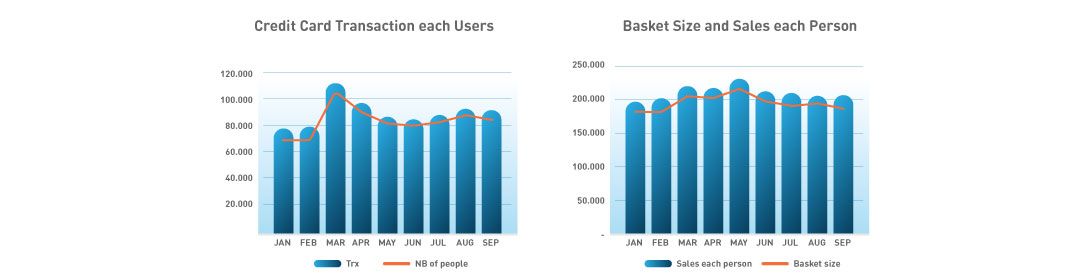

The number of credit card users reached peak on April, yet have declining trends on following months. Implementation of PSBB in April – May which made shopping centers and offices closed (mostly doing WFH), decreased the credit card transaction volume. Then even though credit card transaction was increased in June – September, but the volume is still lower than before PSBB period. It indicates people still “wait and see” on the situation.

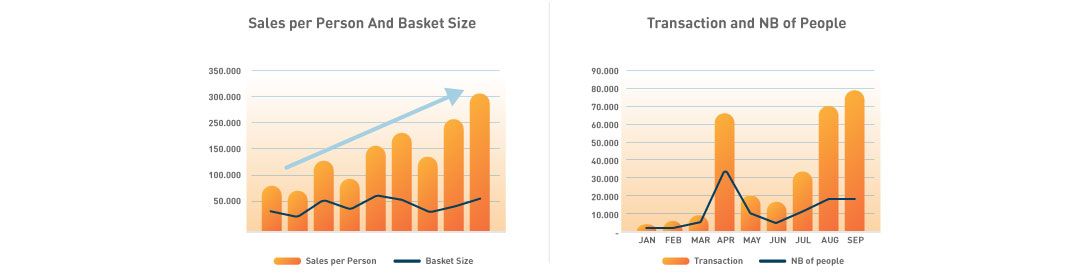

On the contrary, credit card transaction at minimarkets appears have upward trend for months. People have prioritized to fulfill their daily needs over other needs, and they could get it in minimarkets which have advantages in terms of proximity and main needs assortment.

The highest volume of credit card transaction in minimarket was happened in March, in the beginning of Covid-19 break-out, and then got a bit slowing down until May 2020. Still, the volume of transaction with credit cards in minimarkets have uptrend since then.

Credit card users spend in minimarkets on their basic needs, especially on baby needs, cleaning and home cooking categories. The biggest spending is happened on baby needs category, and followed by cleaning category. It indicates that a lot of credit card users are having a family and really care about cleanliness during this pandemic situation. It also related to their more mature in financial capability.

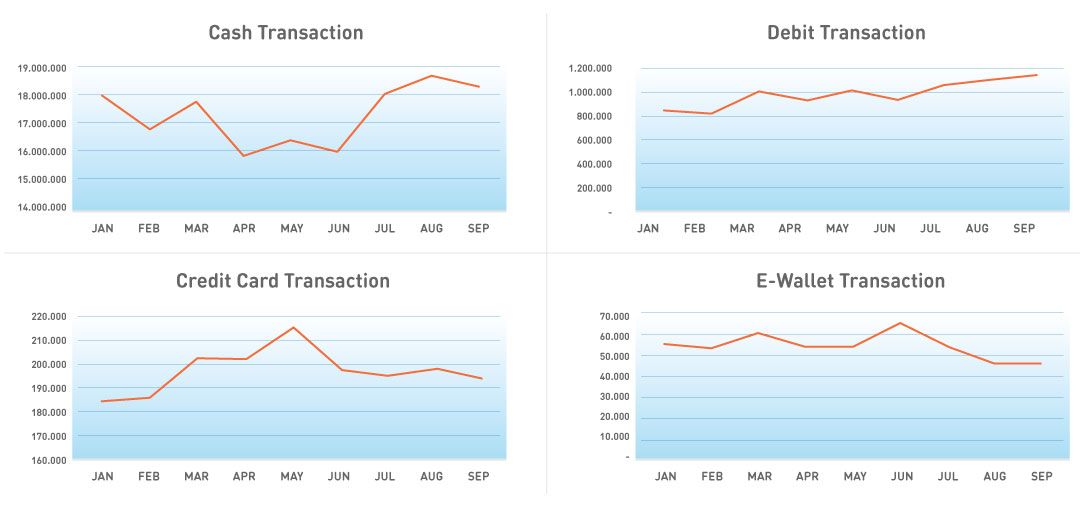

Speaking of payment methods, credit card is still the third rank compared to others. Cash and Debit payments are still very dominating in terms of usage of payment in minimarkets. When Cash, Debit, and Credit Card payments seems have upward trend in 2020, on the other hand the e-wallet payment method is having downward trend, especially in last few months since June.

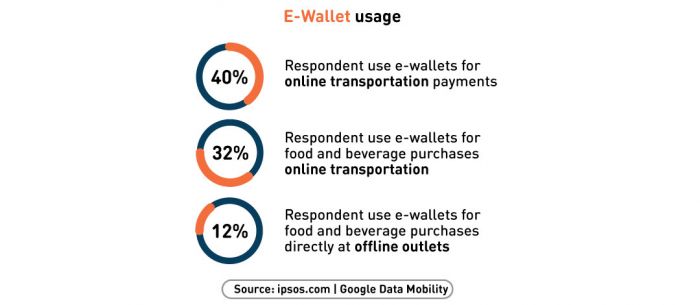

Around 40% of people have usually top up their e-wallet balance for paying online transportation. On the contrary, since PSBB been applied, people were more staying at home, causing their mobility was very low. Since people didn’t go anywhere, they also reduced top up of e-wallets frequency and amount. Therefore, the low balance of e-wallet have reduced possibility to use e-wallet payment when shopping in minimarkets.

Still related to people mobility, due to PSBB implementation, something positive happened in terms of online channel. It also happened in minimarkets, where online shopping was increased asignificantly during this Covid-19 pandemic situation. Either the number of people that had online shopping or their transactions were growing significantly over last few months. In September, the minimarket online sales reached the peak, and it was resulting more than 4x of sales compared to January (before PSBB).

Was your product affected during Covid-19? What types of payment methods are most commonly used to purchase your products? What products drove a significant increase in online sales? Or Is your product among the products that significantly increased online sales? Do you want to know all that? Contact us and we are here to help.