(Source: Badan Pusat Statistik)

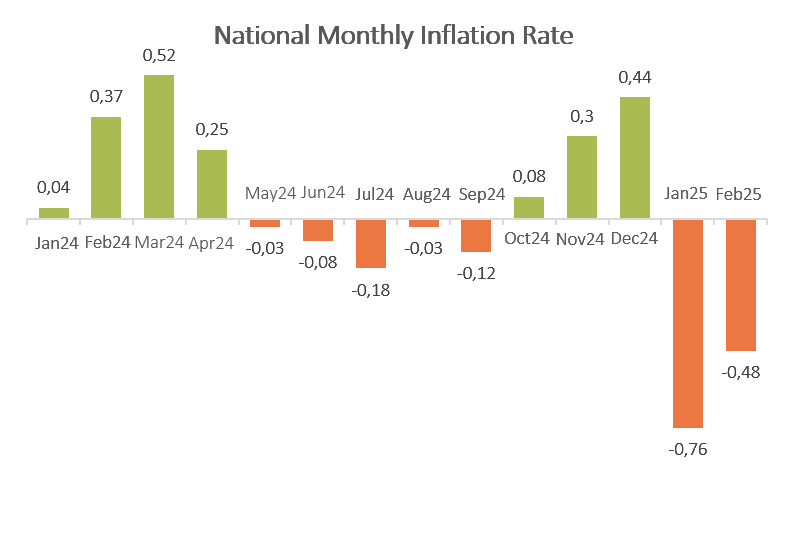

At the start of 2025, the economy was marked by deflation, which saw a sharper decline compared to the previous year. This deflation, lasting for two consecutive months, directly affected the purchasing power of the public, which weakened over time.

(Source: Consumer Insights PT Global Loyalty Indonesia)

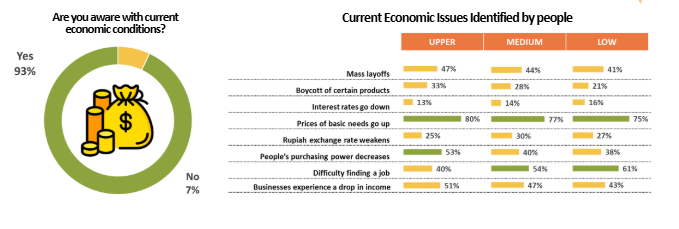

Deep diving into people awareness on current economic conditions, majority of people are aware of it, with rising prices being the most widely recognized issue across all segments. However, the impact differs: the upper-income segment primarily experiences a decline in purchasing power, while the middle and lower-income segments face more fundamental challenges, such as job scarcity and financial instability.

(Source: Consumer Insights PT Global Loyalty Indonesia)

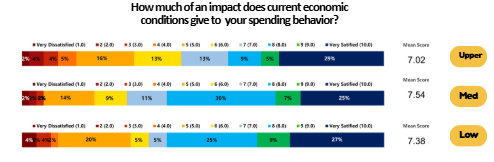

Looking at the impact, from the data we can conclude that the Medium (7.54) & Low (7.38) segment categories tend to feel more impact from the current economic conditions to their spending behavior.

(Source: POS Tracking PT Global Loyalty Indonesia)

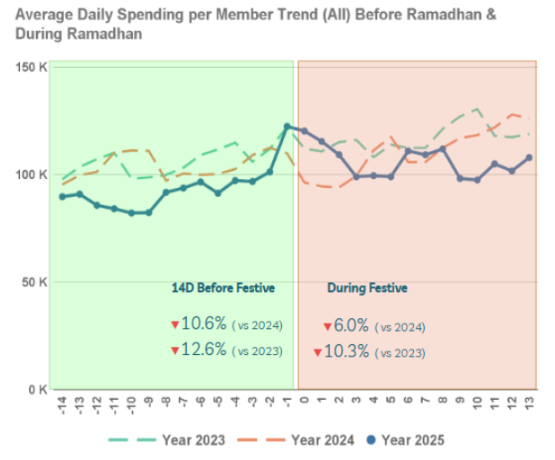

This trend became even more noticeable as Ramadan approached, a period typically marked by a spike in consumer spending. However, this year, the deflation that had been ongoing since the beginning of the year impacted people's consumption patterns, particularly during the 14 days leading up to and during the Ramadan festivities.

(Source: POS Tracking PT Global Loyalty Indonesia)

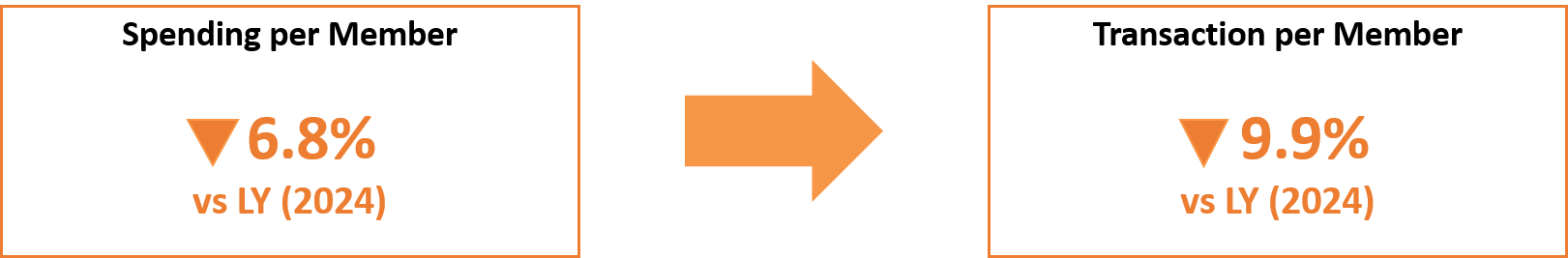

People reduced the number of transactions they made, leading to a decrease in spending per member compared to the previous year. Data showed that in 2025, spending per member during Ramadan festive was notably lower, when consumer spending weakened more than it had the previous year.

(Source: POS Tracking PT Global Loyalty Indonesia)

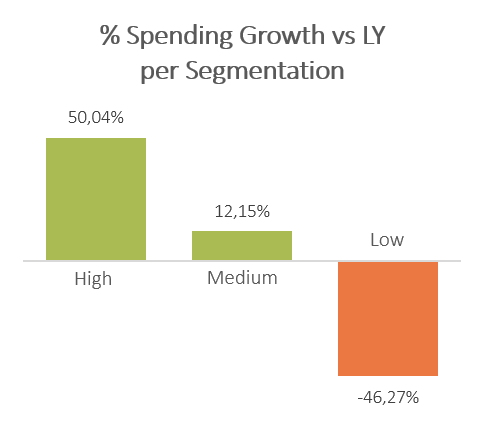

This decline in spending was particularly evident in the low segment, where their spending fell by almost 50% compared to the previous year, significantly contributing to the overall decrease in spending during the festive season.

(Source: Consumer Insights PT Global Loyalty Indonesia)

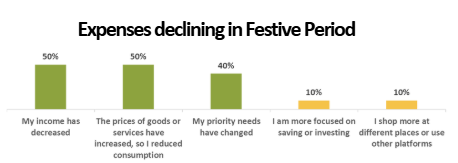

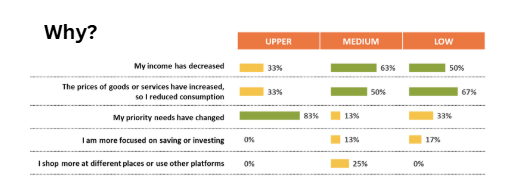

Most consumers in the medium and low-income segments have reduced their spending during festive periods due to declining income and rising prices of goods and services. In contrast, consumers in the upper-income segment are more likely to shift their spending priorities rather than reduce overall expenditure.

(Source: Consumer Insights PT Global Loyalty Indonesia)

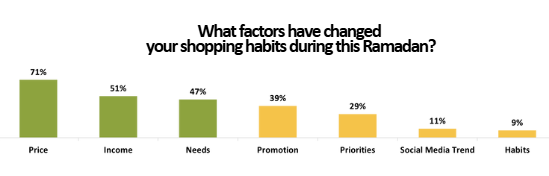

Price, income, and needs are the three primary factors influencing consumers' shifting spending patterns. Prices are perceived to be higher than last year, while income has largely remained unchanged. At the same time, rising needs have further intensified financial pressure, making it difficult for consumers to manage their expenses and prompting them to develop strategies to navigate this challenge.

(Source: POS Tracking PT Global Loyalty Indonesia)

Interestingly, while there was a sharp drop in spending among low segments, certain sub-departments saw an increase in spending, driven by the upper segment. These upper segments showed more aggressive purchasing patterns, with their spending rising more sharply than other groups.

However, the medium segment increased their spending only on staple goods, with no increase in other categories. Unfortunately, despite some growth in specific sub-departments driven by the upper segment, almost all sub-departments experienced a decline in spending from low segment.

(Source: Consumer Insights PT Global Loyalty Indonesia)

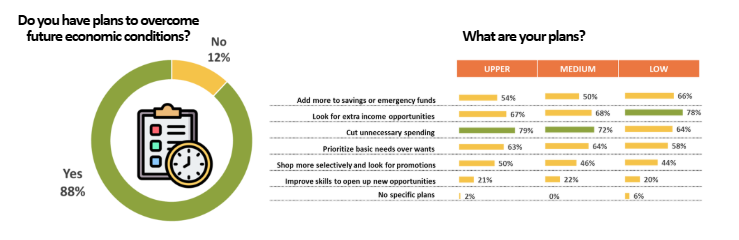

Did they have any plan to overcome this situations? From the data we found that majority of people have plans to navigate future economic conditions. Consumers in the upper and medium-income segments tend to focus on cutting unnecessary expenses, whereas those in the low-income segment are more inclined to seek additional income opportunities.

We hope these insights and data are helpful to you. If you’d like to learn more about your product, we can assist you further, as we have access to over 20 million members and millions of daily transactions for in-depth analysis, including consumer behavior and other product data.