Generation X (44-57 y.o.), feel satisfied about their income; with an average monthly earnings between IDR 7.5 million and IDR 10 million. Meanwhile, the younger generations—Generation Z (18-27 y.o.) and Millennials (28-43 y.o.)—are left feeling some challenges, with their earnings averaging on IDR 3 million to IDR 5 million per month.

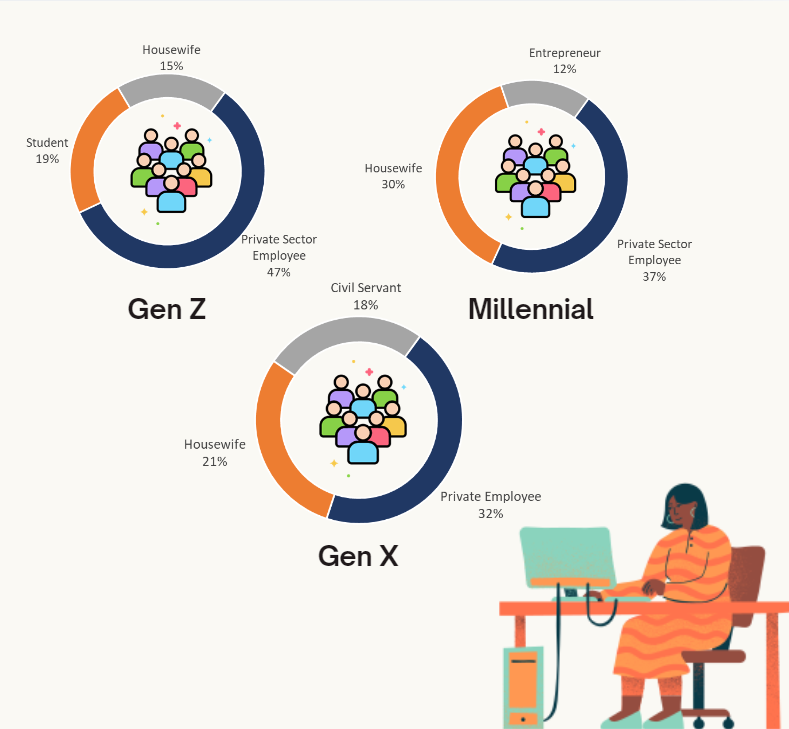

Across all generations, private sector employees are the most dominant occupation (more than 30% on each generations), followed by housewife on the second place.

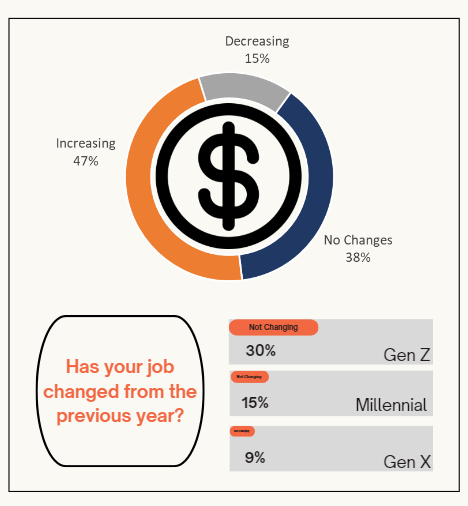

Looking at the income comparison from two years ago, the increase in their income is most noticeable among Gen Z (52%), as many have experienced job transitions over the past two years.

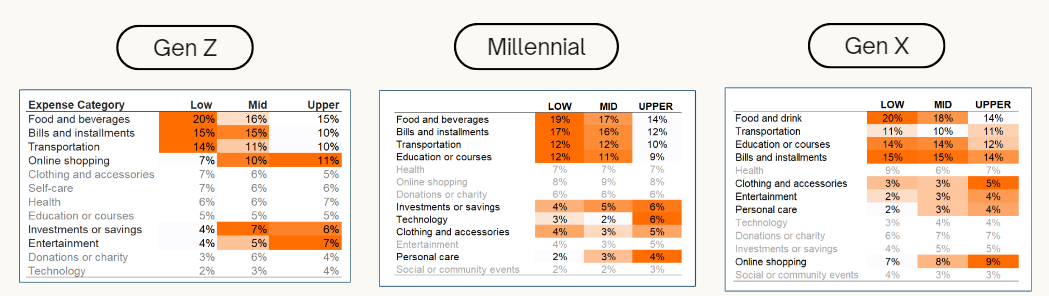

Now we're about to look at their monthly spending habits. Gen Z spends IDR 1-3 million monthly, with low SES groups spending below IDR 1 million. Millennials and Gen X typically spend over IDR 3 million, except for their low SES groups, which also spend under IDR 1 million.

Spending patterns are quite similar across all generations: Upper SES groups allocate more of their budget to non-essential items (entertainment, self-care, and savings), while lower and middle SES groups focus more on basic necessities.

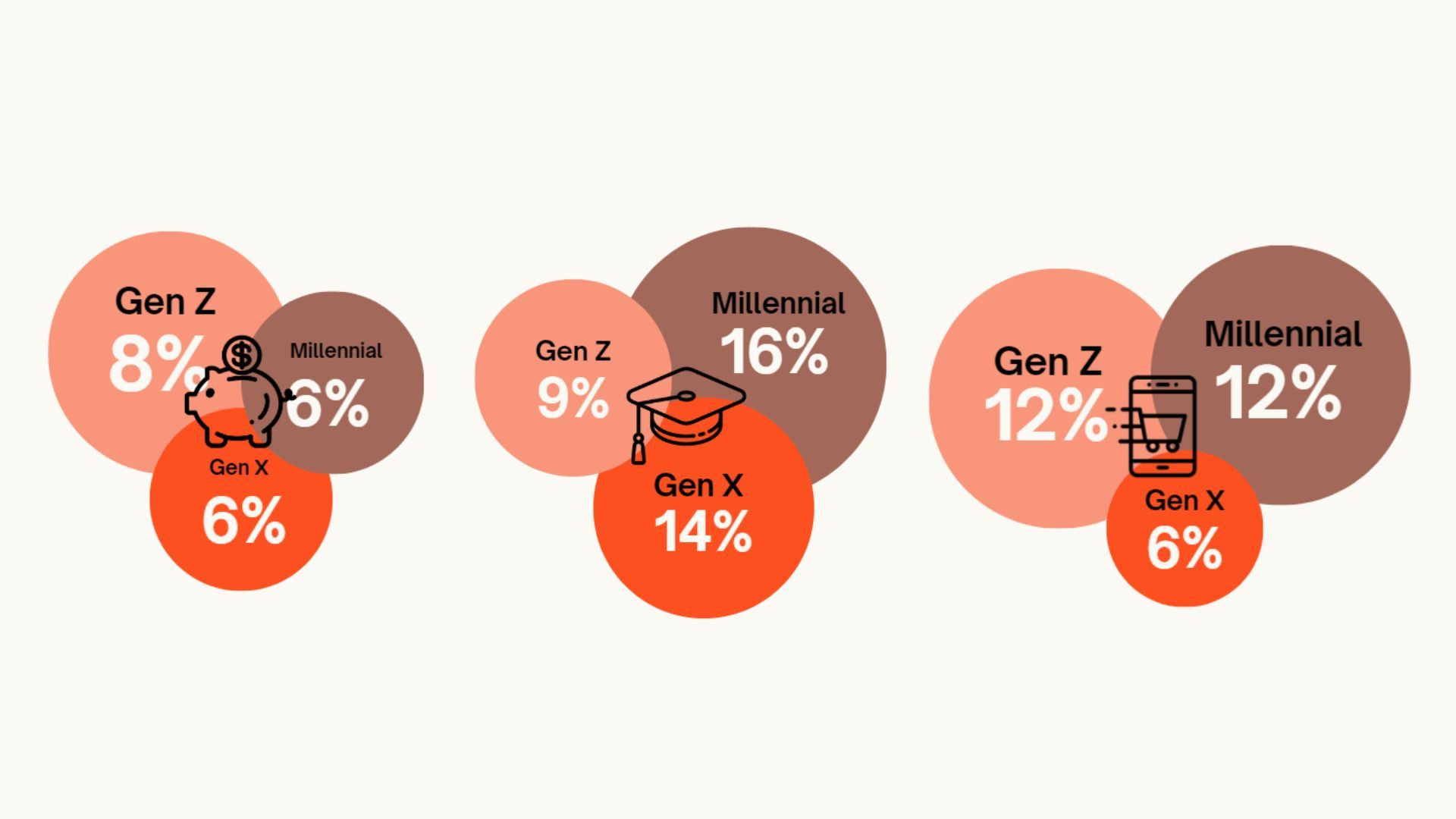

Moreover, we tried to look unique spending priority across the 3 generations. In this case, Gen Z has the highest percentage in the savings category (up to 8%) as a primary need, driven by concerns about their uncertain and long future. Meanwhile Millennials prioritize spending on education the most (up to 16%), primarily for their children's needs, such as tutoring, school fees, and self-development programs. On Gen X, they have the lowest percentage of online shopping (6%) as they have a lower inclination to purchase non-essential items.

When discussing the current economic issues and conditions, there are several problems highlighted by many members, including:

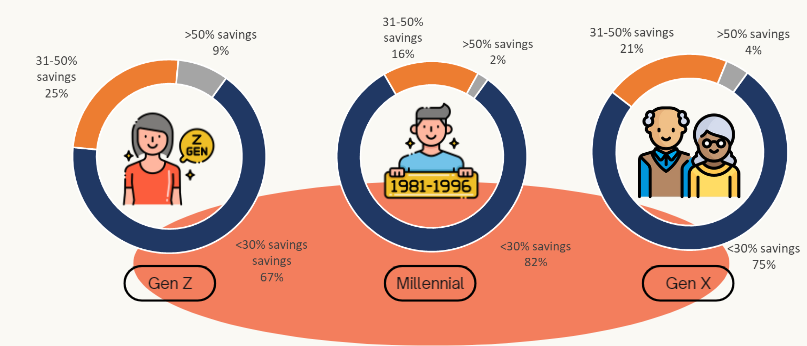

Across all generations, the higher their socioeconomic class, the greater the proportion of their income allocated to savings. Observing on their saving management, those in the upper SES not only save in bank accounts but also invest in physical assets such as gold or property.

Other than savings, many members also seek for cheaper alternative products, hunt for promotions, cut back on non-essential spending, or look for additional sources of income as a respond to handle rising prices & future economic plans.

We hope these insights and data are beneficial for you. Suppose you want to know more about your product. We can help you because we have more than 16 million members with millions of daily transactions for analysis, such as consumer behavior and other product data.