In November 2023, there was a lot of discussion about the distribution of Wolbachia mosquitoes (Aedes aegypti mosquitoes infected with Wolbachia bacteria) by the government in several cities in Indonesia as the latest innovation to reduce dengue fever cases. Complementing the existing mosquito treatment programs such as 3M Plus and fogging, the government aims to achieve a dengue-free Indonesia through this program. Despite the ongoing discussions about the pros and cons of this innovation, it is evident that mosquitoes have received special attention from the government due to their nature as vectors of various disease-causing viruses/bacteria, one of which is dengue fever.

The public often regards mosquitoes as nuisances, posing a notorious threat if ignored. In daily practice, aside from the programs mentioned earlier, people commonly deal with mosquitoes by using mosquito insecticides. Mosquito insecticides are readily available for purchase at minimarkets, providing the public with convenient access to these products. GLI conducted a study on consumer behavior regarding mosquito insecticides, analyzing transaction data from minimarkets in 2023 up to October. The study revealed intriguing insights into the public's behavior about purchasing mosquito insecticides.

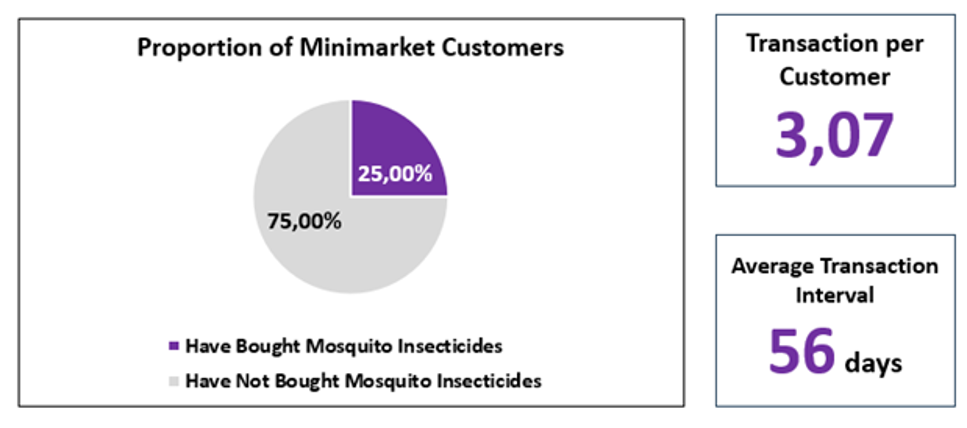

Out of people who have shopped at minimarkets, only 25% have purchased mosquito insecticides. It may imply that the demand for mosquito insecticides is still not very high. On average, buyers of mosquito insecticides make approximately three purchases at minimarkets, with a repurchase interval of around 56 days.

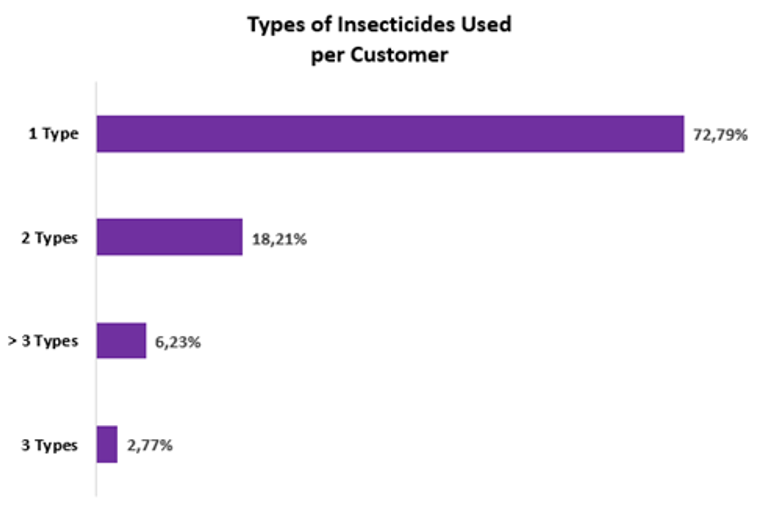

Among the different mosquito insecticide types available at minimarkets, the majority of consumers exhibit a consistent preference for a single type of mosquito insecticide, with over 70% purchasing only one specific type of mosquito insecticide.

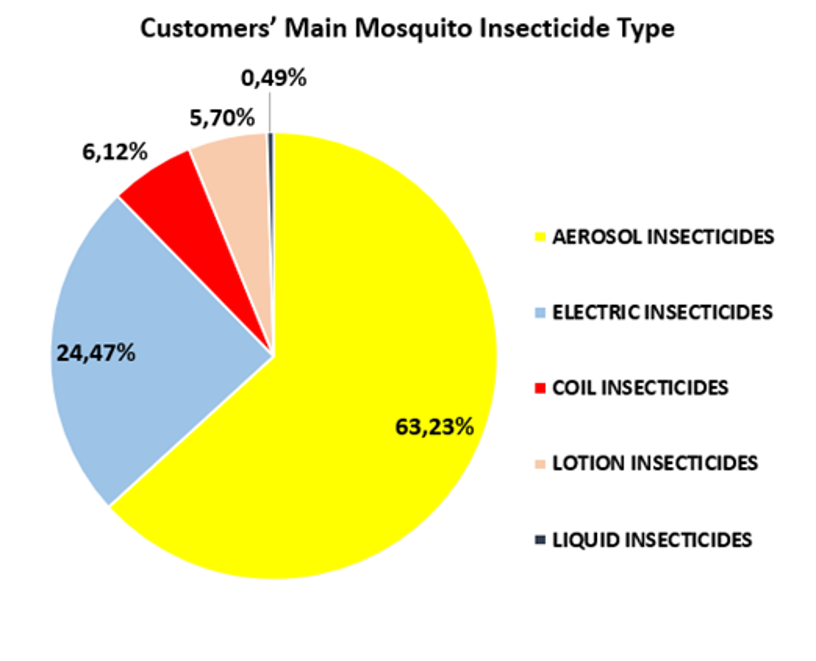

This consistency may also indicate that mosquito insecticide consumers have personal preferences that make them feel comfortable. Among the several mosquito insecticide types commonly sold in minimarkets, aerosol insecticides are the top choice for most minimarket consumers with a proportion exceeding 60%. Electric insecticides are also quite popular with consumers with a proportion of almost 25%.

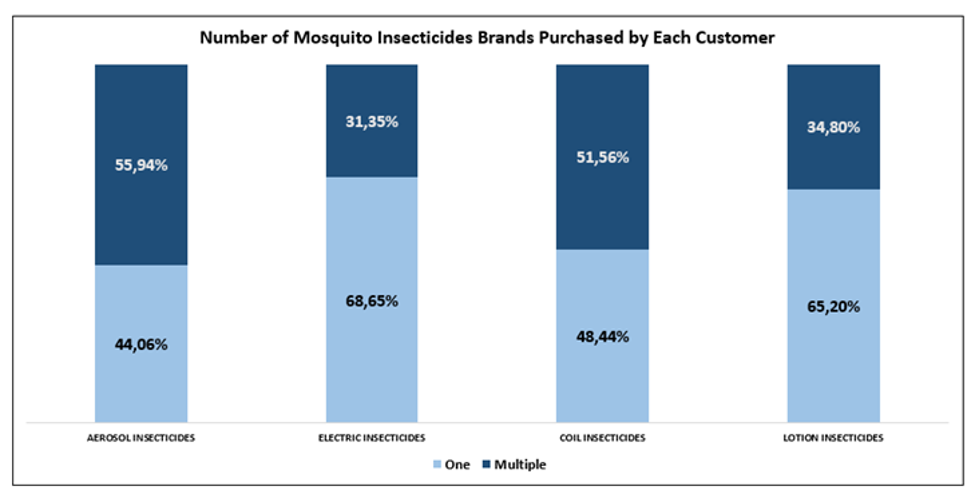

Despite having individual preferences for specific types, the same principle does not necessarily apply to brand preferences within each type. While consumers of electric and lotion insecticides typically show a strong inclination toward a particular brand, consumers who use aerosol and coil insecticides tend to lack a specific brand preference. This is evident in the slightly larger proportion of multiple-brand buyers in aerosol and coil types while the proportion of single-brand buyers in electric and lotion types far exceeds multiple-brand buyers with a difference exceeding 30%.

Despite having individual preferences for specific types, the same principle does not necessarily apply to brand preferences within each type. While consumers of electric and lotion insecticides typically show a strong inclination toward a particular brand, consumers who use aerosol and coil insecticides tend to lack a specific brand preference. This is evident in the slightly larger proportion of multiple-brand buyers in aerosol and coil types while the proportion of single-brand buyers in electric and lotion types far exceeds multiple-brand buyers with a difference exceeding 30%.

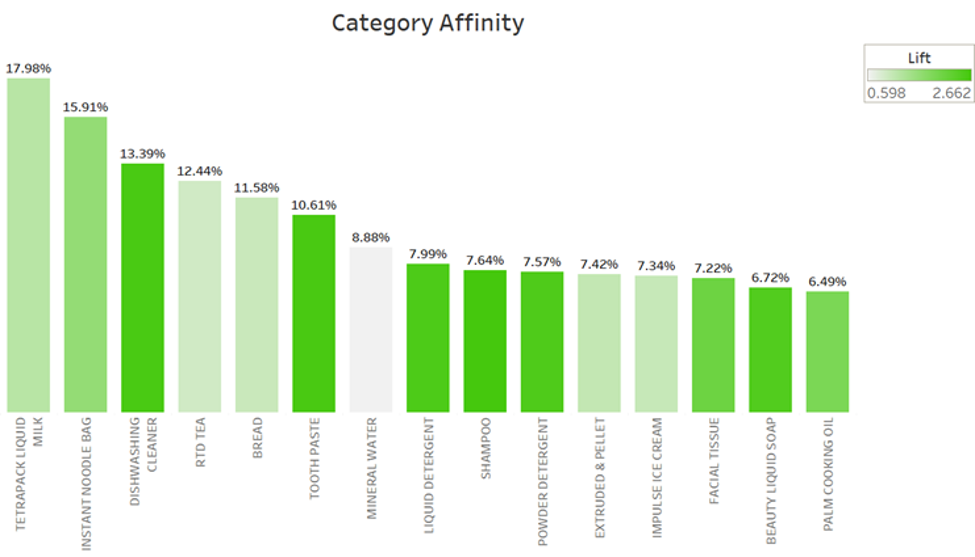

Additionally, among the 15 categories of items most commonly bought alongside mosquito insecticides in minimarkets, a strong association was observed between mosquito insecticides and household products (such as dishwashing cleaner and detergent) and personal care (such as toothpaste, shampoo, tissue, and soap). The association is reflected in the high lift values in these categories, which are indicated by the solid green color. The association is positive, suggesting that the purchase of mosquito insecticides along with household and personal care products is not a coincidence. It suggests that mosquito insecticides are purchased intentionally together with personal and household hygiene items.

From these results, it can be concluded that the demand for mosquito insecticides is still not very high, with a repurchase time occurring approximately every 2 months. Consumers who choose to buy mosquito insecticides seem to do so in a planned manner, often alongside hygiene and beauty products. While there is a likelihood of personal preferences for the type of mosquito insecticide, the presence or absence of brand preferences appears to vary depending on the specific type of mosquito insecticide used.

We hope these insights and data are beneficial for you. Suppose you want to know more about your product. We can help you because we have more than 16 million members with millions of daily transactions for analysis, such as consumer behavior and other product data.