The year 2023 holds significant importance for football in Indonesia. The nation with the most football enthusiasts worldwide seizes the opportunity to host a prestigious football tournament for youth age groups, namely the 2023 U-17 FIFA World Cup, and actively participates in the competition. This event is good news for the people of Indonesia as it opens up many opportunities for advancements in the country's sports and economic sectors.

As one of the most popular sports in Indonesia, the FIFA World Cup is a spectacle highly anticipated by both football enthusiasts and those who eagerly embrace the hype of the biggest sports event in the world. Reflecting on 2022, when the World Cup for the senior groups took place in Qatar from November 20 to December 18, 2022, the public's enthusiasm was evident in the growing number of subscribers to video service media platforms broadcasting the World Cup. With the rising number of World Cup viewers, people have embraced specific types of food and beverages as their football refreshments, such as snacks and soft drinks.

This preference has led to a particular consumption pattern reflected in the public's shopping behavior, one aspect of which is evident in minimarkets, serving as a type of store easily accessible to them. To capture the pattern, PT Global Loyalty Indonesia conducted a study on snacks and soft drinks transaction trends in minimarkets during the 2022 World Cup. Comparisons were made with two months before the 2022 World Cup started. The parameters used are sales volume, serving as an indicator of demand for purchased goods, and sales per customer, serving as an indicator of spending per consumer on purchased goods.

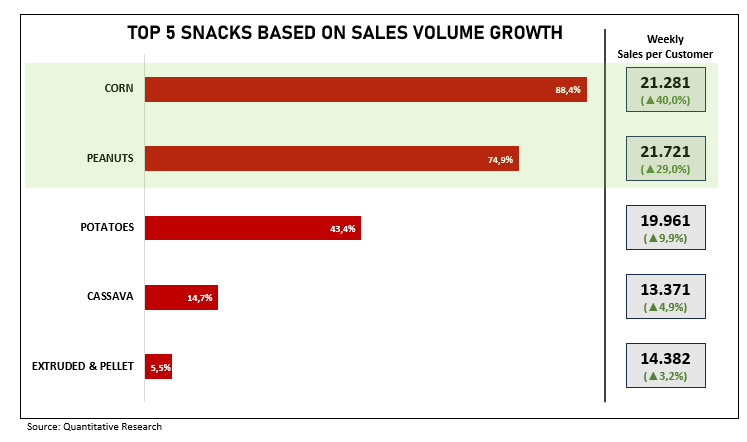

Compared to before the 2022 World Cup (Pre-WC 2022), the sales volume of snacks and soft drinks increased by 19.4% and 24.9%, respectively.

Upon further examination, notable performance growth is observed in the snack categories of peanuts and corn, with sales volume growth exceeding 70% and weekly sales per customer growth surpassing 25%, both of which are greater than the overall growth in the snack category.

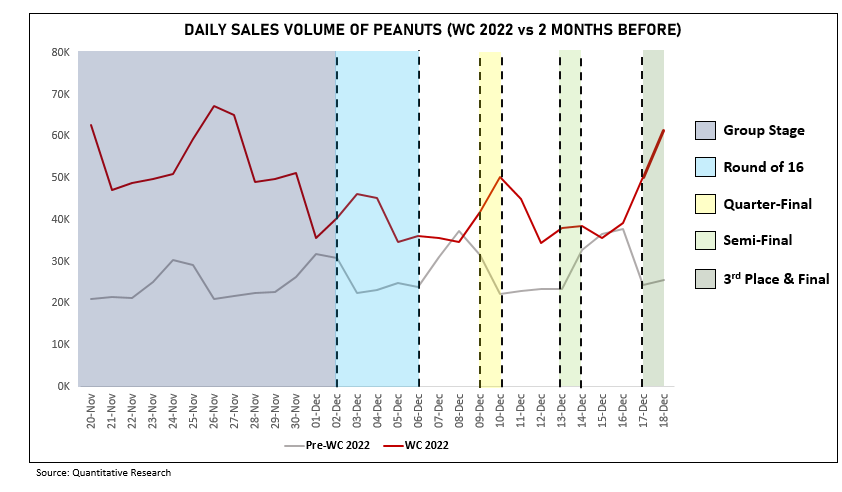

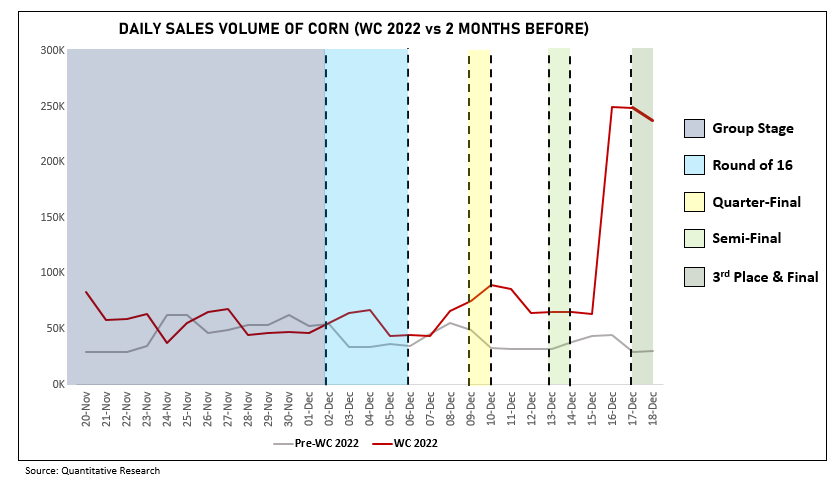

When analyzing the daily trend, a distinction is evident in the patterns of increasing sales volume between the two categories.

The peanuts category tended to have high sales volume from the start, which then stagnated after the group stage until it started to pick up again when the World Cup entered the decisive stage, encompassing the third-place playoff and the final.

On the other hand, in the corn category, sales volume started to show consistent performance above Pre-WC 2022 after entering the knockout stage. A remarkable surge happened when the 2022 World Cup entered the decisive stage.

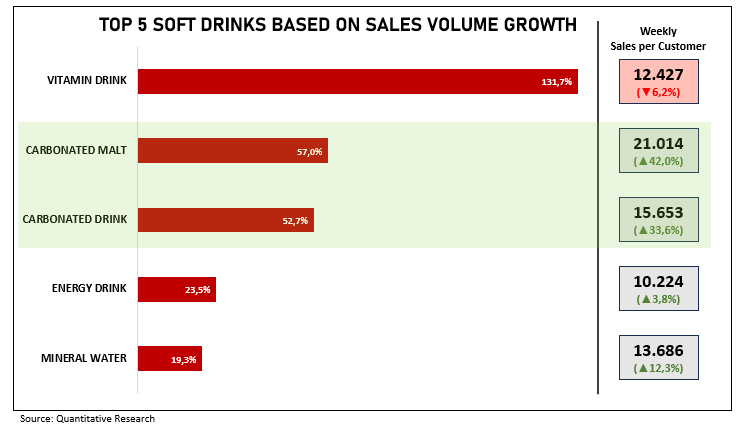

Meanwhile, among the soft drinks, vitamin drinks, carbonated drinks, and carbonated malts are the categories with a significant increase in sales volume of over 50%. However, upon further examination, it becomes evident that only carbonated drinks and malts exhibited a notable increase in sales per customer.

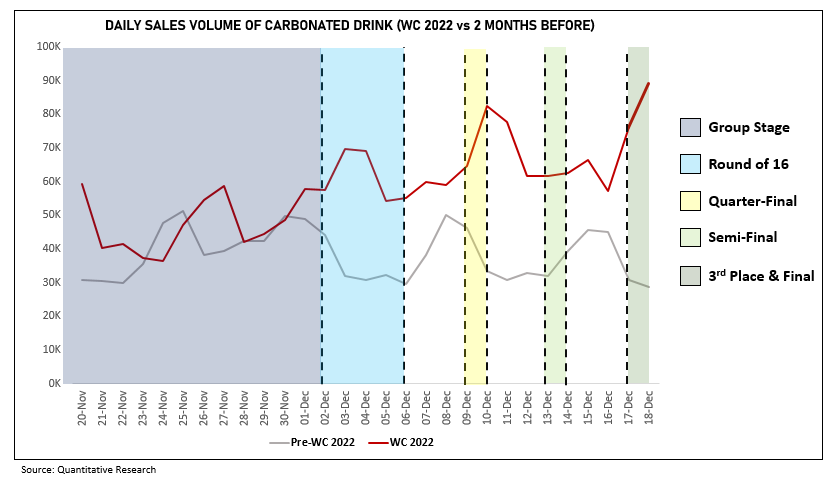

There are also variations in the daily sales volume trends between these two soft drinks categories. In the case of carbonated drinks, the sales volume displayed an upward trend as the 2022 World Cup progressed, reaching its peak during the decisive stage.

On the other hand, the sales volume of carbonated malts just started to experience a significant jump in the decisive stage.

In conclusion, the 2022 World Cup reflects the heightened market interest in various snack types (peanuts and corn) and soft drinks (carbonated drinks and carbonated malts), evidenced by an increase in sales volume and sales per customer, especially during the decisive stage (third-place playoff and final).

We hope these insights and data are beneficial for you. Suppose you want to know more about your product. We can help you because we have more than 13 million members with millions of daily transactions for analysis, such as consumer behavior and other product data.