Kids Formulated UHT milk Growth Story: Behavior Shift, or New Segments?

Milk has long played a crucial role in supporting children’s growth, making kids formula milk one of the top priorities in many households’ shopping baskets. The market itself has grown rapidly, offering an increasingly diverse range of products—from mainstream options to super-premium formulas aimed at more specific nutritional needs.

In recent years, children’s powdered formula milk has begun crossing over into the UHT (ultra-high temperature) type, presenting ready-to-drink formulations with nutrient profiles that rival traditional powdered products. This shift signals a broader trend: parents today are seeking convenience without compromising on nutrition.

But as UHT formulated milk gains traction, a key question arises: can these ready-to-drink variants truly replace conventional powdered formula?

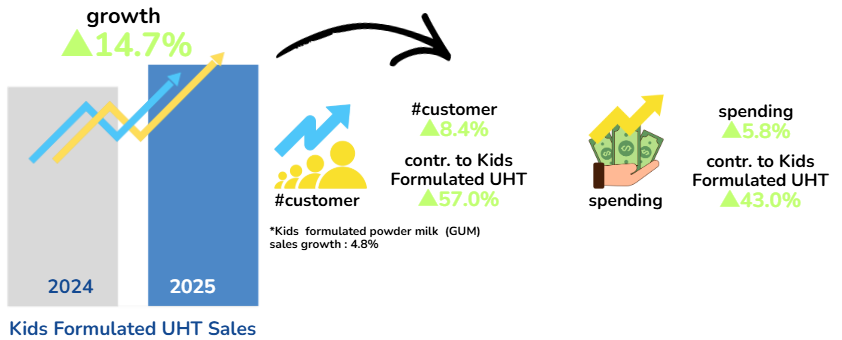

Kids Formulated UHT Performance

Kids Formulated UHT is literally on a rise, jumping 14.7%, way higher than its similar category, Kids Formulated Powder Milk (GUM) 4.8%. This boost mainly comes from a 8.4% in buyers that drove almost 60% of the total sales growth, plus a 5.8% increase in spending . More buyers + slightly bigger baskets = Kids Formulated winning hard.

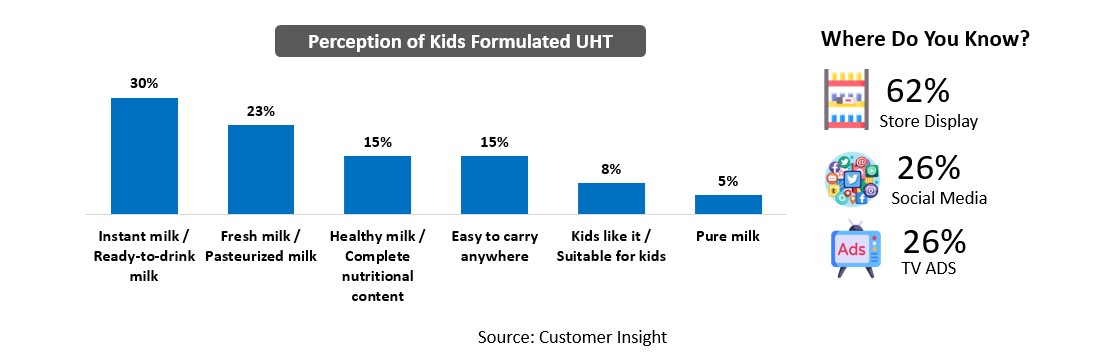

Most consumers perceive Kids Formulated UHT as instant milk or ready-to-drink milk, and fresh milk or pasteurized milk. They usually learn about it from store displays, social media, and TV ads.

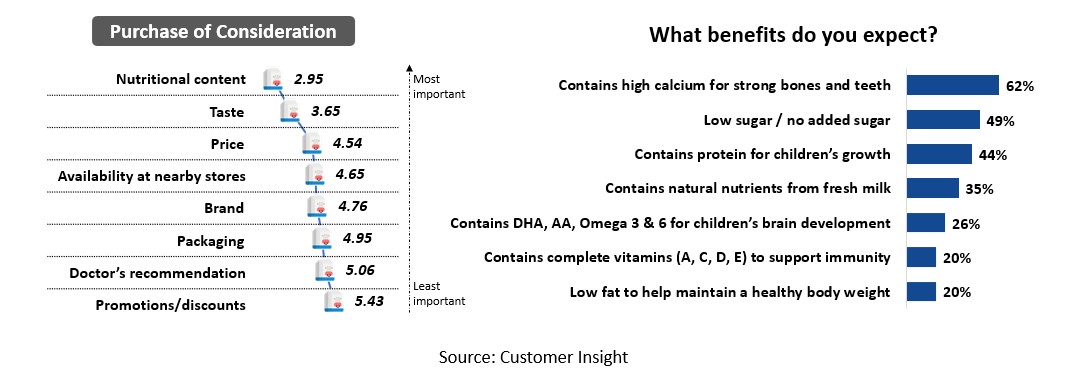

Their main considerations when choosing Kids Formulated UHT are its nutritional content, taste, and price. The nutritional benefits they expect from Kids Formulated UHT include calcium for strong bones and teeth, low sugar content, and protein to support their child's growth.

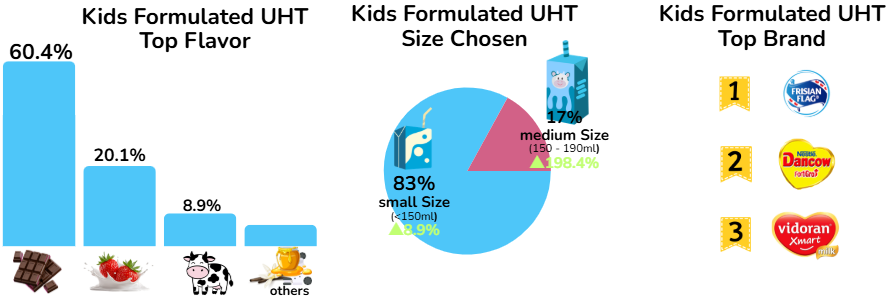

Kids Formulated UHT comes with plenty of flavor options, but chocolate still takes the crown. For pack sizes, small packs remain the most popular, though medium packs are starting to rise fast. And when it comes to market share, mainstream brands still dominate the space.

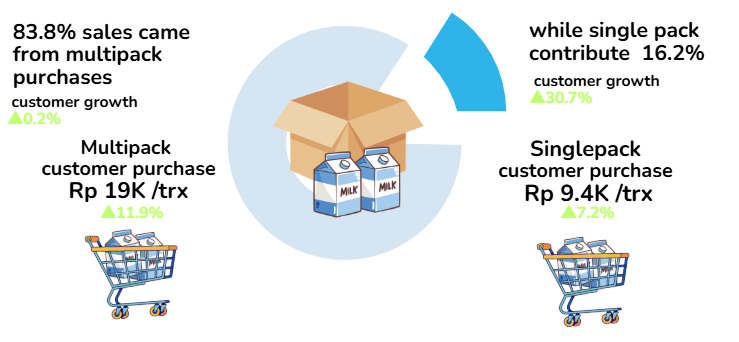

Most customers still spend on multipacks, but in this year, there’s a noticeable rise in shoppers buying single packs with growth is over 30%, while multipack buyers are pretty much flat. Interestingly, although multipacks customer is staying flat, they tend to spend higher than previous year.

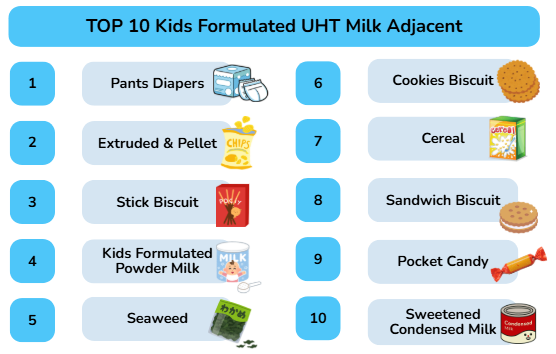

Turns out, customers often pick up kids formulated UHT milk along with kid-related essentials— such as diapers, snacks, or biscuits. What’s even more interesting, some customers also grab product kids formulated powder milk. This hints that some customer might be using product kids formulated UHT milk and product kids formulated powder milk side-by-side.

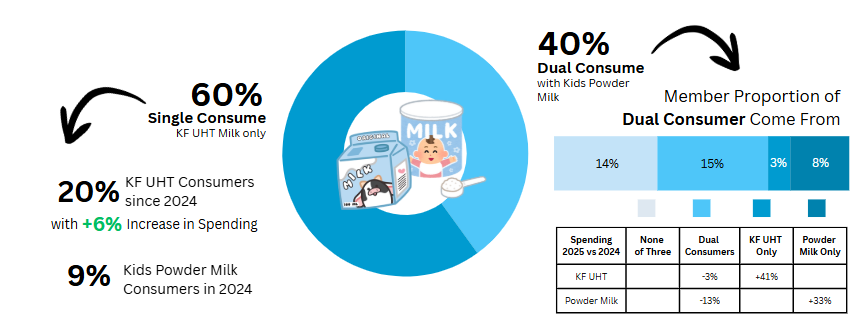

Among current 60% single consumers, the 20% of it had already Kids Formulated UHT before with now increasing 6% of their spending. While other 9% are former Kids Formulated Powder Milk users who have shifted to Kids forlumated UHT. Meanwhile, within the 40% of dual consumers, 15% were previously are already dual users but are now reducing their spending in both categories—especially in Kids powder milk, with dropped by 13%.

Dual Consumption Perspective

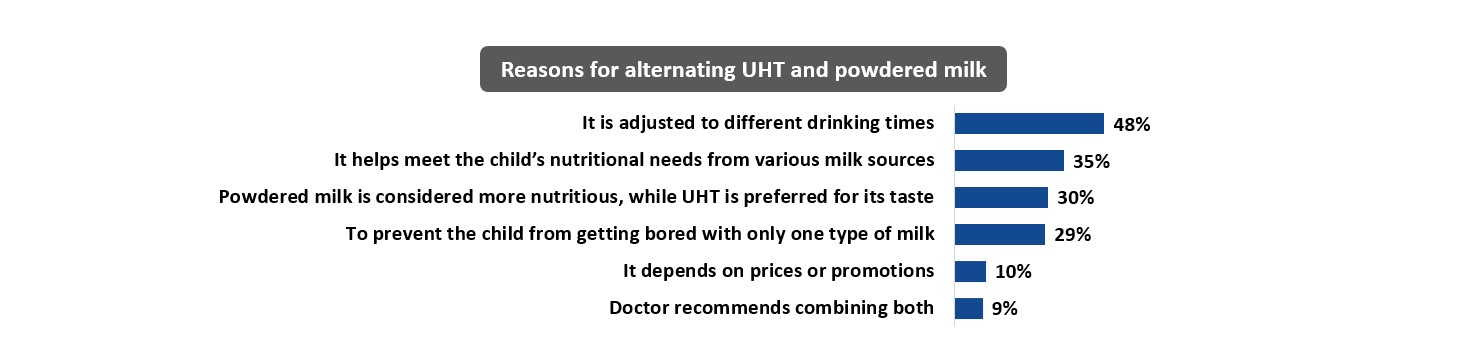

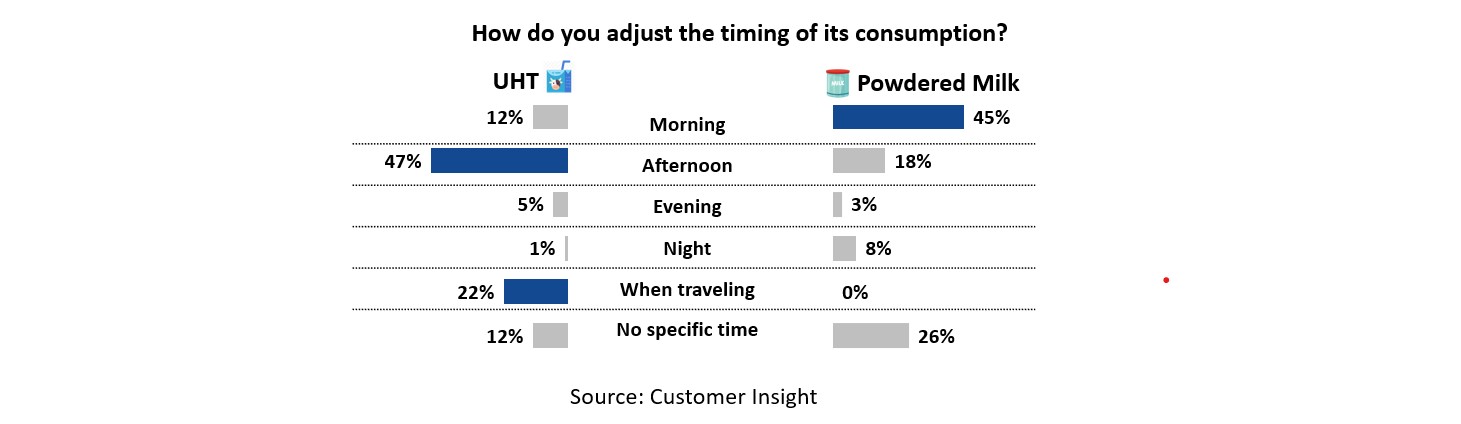

Consumers give their children UHT and powdered milk alternately to adjust their drinking schedule and to meet their nutritional needs from different types of milk. They mostly give UHT during the day and when going out, while powdered milk is usually given in the morning.

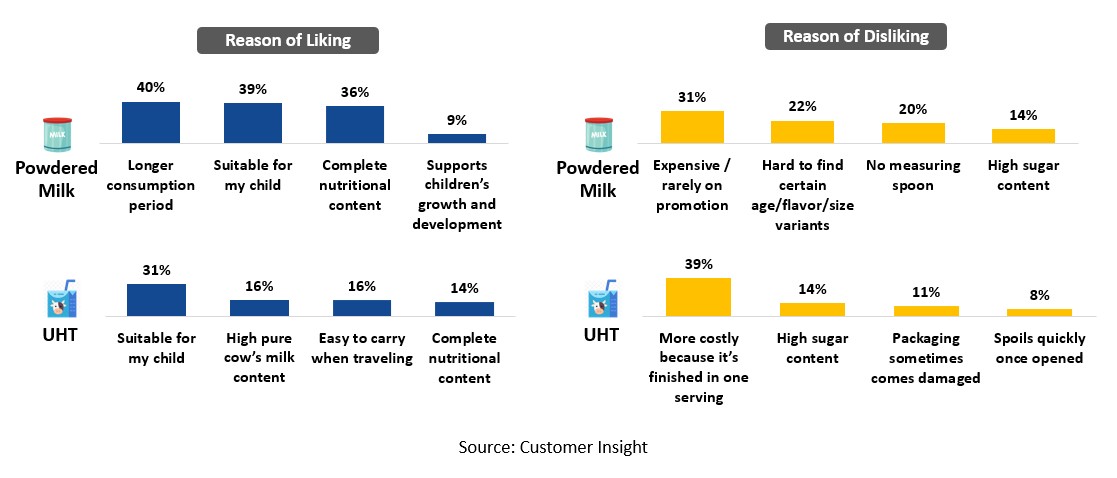

They like powdered milk because it can be consumed over a long period of time and suits their child, and UHT milk is also liked because it fits their child in terms of taste and benefits. Meanwhile, what they dislike about powdered milk is that it is expensive/rarely on promotion and its variants (age/flavor/size variants) are hard to find, and UHT milk is disliked because it is more wasteful and is finished in just one serving.

Lapsed From Powdered Milk Perspective

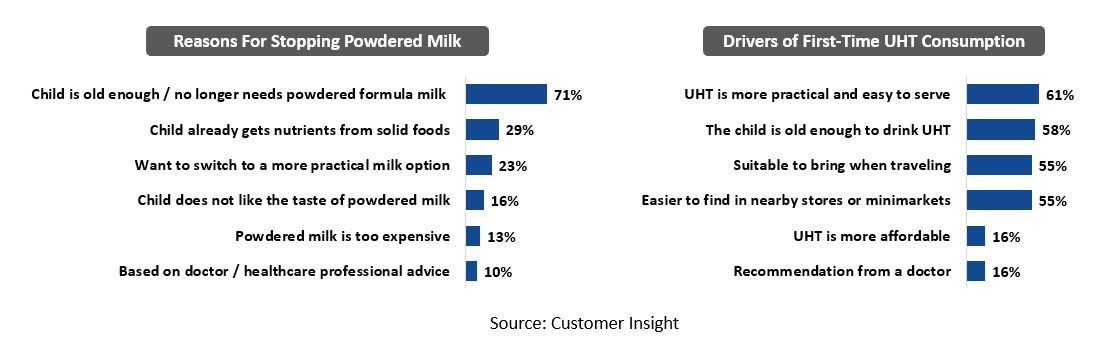

Consumers stop consuming powdered milk because their child is older / no longer needs powdered formula milk and they switch to kids formulated UHT, which is more practical and suitable for children of that age.

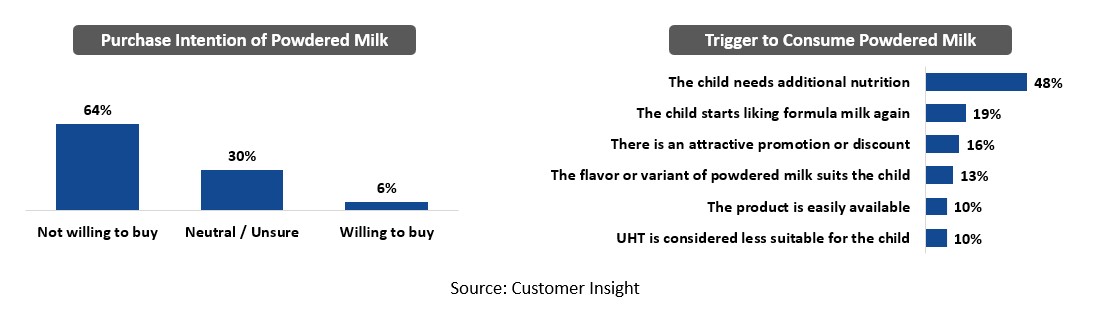

Most of them do not want to return to powdered milk unless their child needs additional nutrition or starts liking powdered formula again.

In conclusion, while the kids powder milk slows down, growth in Kids Formulated UHT milk in 2025 is driven not only by more customers buying it but also by higher spending. Parents who switched from Kids Powder Milk to Kids Formulated UHT milk feel that, at their child’s current age, Kids Formulated UHT is enough to cover their kids nutritional needs. While dual users, use both products mainly based on timing and convenience of its product.

We hope these insights and data are helpful to you. If you’d like to learn more about your product, we can assist you further, as we have access to over 21 million members and millions of daily transactions for in-depth analysis, including consumer behavior and other product data.