Shifting Sips: The Decline of RTD Juice

Lately, RTD beverages remain very popular as customers perceive them to be more practical. RTD Juice, as one of the RTD beverage types, also takes part in enlivening the market. Some people consume RTD Juice to fulfill their vitamin and nutrition needs, making it a practical alternative to fresh juice. However, others still perceive RTD Juice as containing more sugar and preservatives.

So, how is the current condition of the RTD Juice market? Do customers still choose it, or are they starting to switch to other beverages perceived as healthier?

In this article, we explore the condition of the RTD Juice market in minimarkets. We also delve into customer behavior and perception toward RTD Juice — uncovering the reasons why they choose RTD Juice or switch to other beverages. This study combines insights from a survey of 800 respondents and POS transaction tracking data.

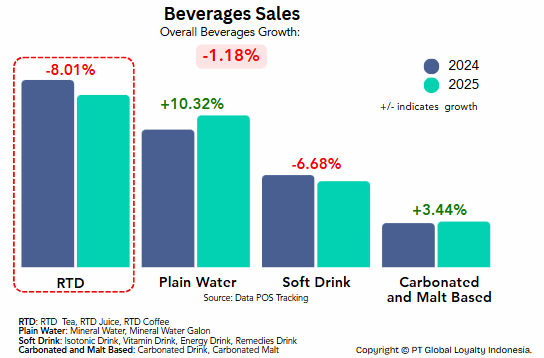

Based on transaction data, beverage sales experienced a slight decline, driven by a decrease in RTD sales — which contributed the most to total beverage sales. The RTD category includes RTD Tea, RTD Juice, and RTD Coffee. In contrast, Plain Water — which includes bottled and gallon mineral water — showed notable sales growth of 10%.

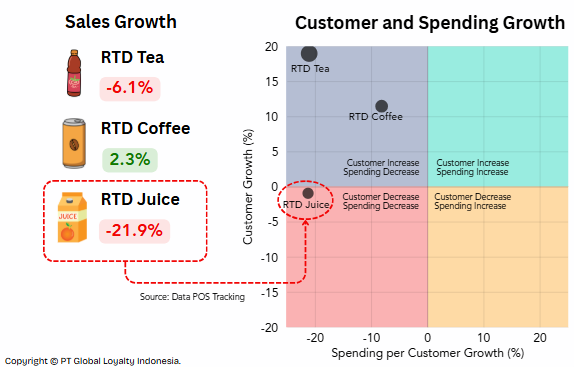

Within the RTD group, only RTD Coffee experienced slight sales growth. Meanwhile, RTD Tea and RTD Juice both declined, with RTD Juice showing a deeper drop of more than 20%. While other RTD types still managed to expand their customer base (despite lower spending), RTD Juice faced a decline in both customer base and spending, making it the main driver behind the overall RTD group’s downturn.

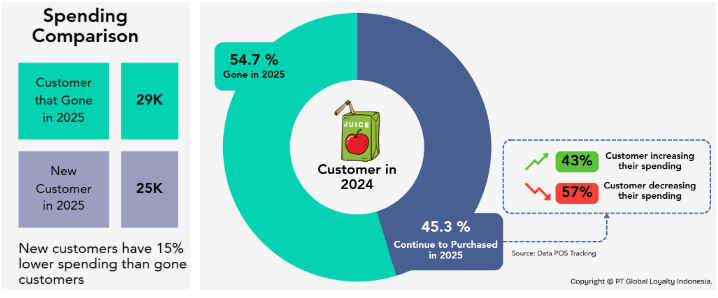

Around 54.7% of customers who purchased RTD Juice in 2024 stopped buying it in 2025. The spending of these “gone customers” was higher than that of new customers, who did not purchase in 2024 but did in 2025. Among customers who continued purchasing RTD Juice across both years, most decreased their spending. The lower spending of new customers, combined with the reduced spending of continuing ones, led to an overall decline in RTD Juice spending per customer.

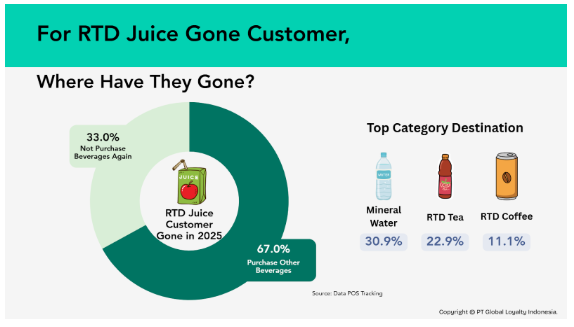

However, these gone customers didn’t leave the beverage category entirely. Most still purchased other beverages, with Mineral Water becoming their top destination category, followed by other RTD beverages.

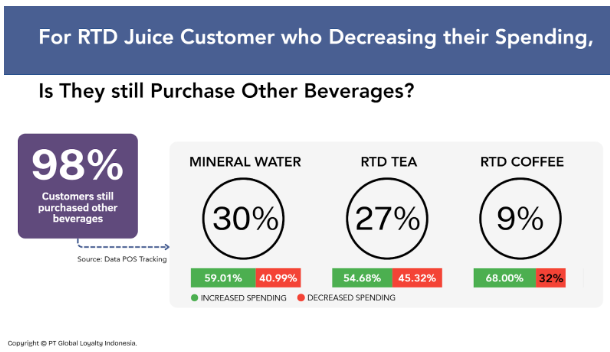

For RTD Juice customers who still purchased RTD Juice but decreased their spending, 98% also bought other beverages. Mineral Water and RTD Tea became their main choices. In those categories, their spending increased — indicating a shift in wallet share from RTD Juice to other beverages.

Following the decline observed in the RTD Juice category, it is important to explore the factors driving this change from the customers’ perspective. How do customers perceive RTD Juice?

Many associate RTD Juice with being artificial and high in sugar, rather than truly fruit-based or healthy. This presents an opportunity for brands to reposition the category by emphasizing natural ingredients, freshness, and real fruit benefits.

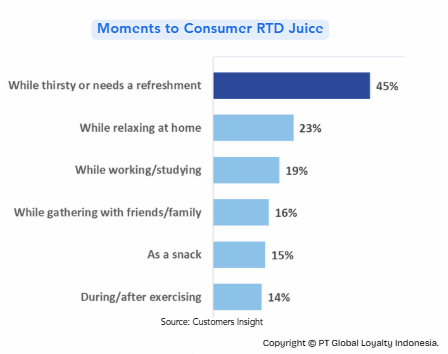

Nearly half of consumers drink RTD juice at least once a week. Customers still drink RTD Juice regularly, especially when they need something quick and refreshing. Despite growing interest in other beverage options, RTD Juice continues to serve as a familiar and convenient choice for many.

Then, why are their consumption and spending on RTD Juice declining?

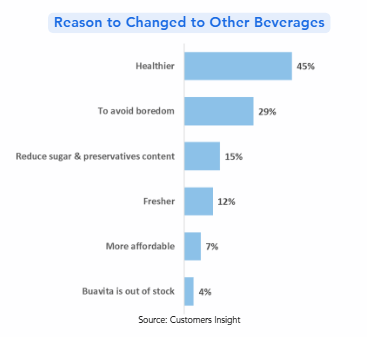

Among the 67% of consumers who now purchase beverages from other categories, most are seeking healthier options and trying to avoid boredom. This indicates that consumers are actively exploring variety and wellness-oriented choices — showing a need for RTD Juice brands to innovate with fresher, more natural, and exciting offerings to stay relevant.

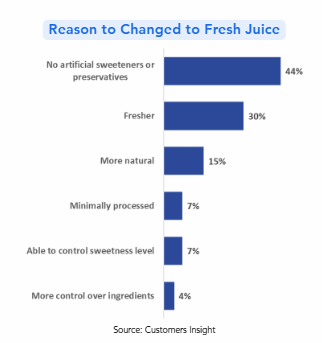

Meanwhile, among those who no longer purchase any RTD beverages, 52% have shifted to fresh juice, as they prefer to avoid preservatives and seek fresher, more natural options.

The decline of RTD Juice reflects a shift in how consumers define “healthy.” As they move toward simpler and more natural choices like mineral water and fresh juice, RTD Juice needs to rebuild its image — not just as a convenient drink, but as one that truly aligns with wellness-driven lifestyles.

We hope these insights and data are beneficial for you. If you want to know more about your product’s performance, we can help. With over 22 million members and millions of daily transactions, we provide in-depth analysis of customer behavior and product performance to support your business decisions.