Korean-Inspired Food Products in Indonesia: Enduring Consumer Preference or Passing Trend?

In recent years, Korean culture has remained highly popular in Indonesia due to the influence of K-pop, Korean dramas, and social media, with Indonesia ranking first globally in interest toward aspects related to Korean at 86.3%

Source: GoodStats Data (survey conducted by the Ministry of Culture, Sports and Tourism (MCST) of South Korea)

This popularity has encouraged the appearance of Korean products in the Indonesian market, particularly food products offering Korean flavor variants. So, how these products are currently performing and how consumers perceive them, particularly whether they have become a sustained consumer preference or are merely being tried out of curiosity?

In this article, we explore how Korean flavor products are currently performing in market. We examine purchasing behavior, motivations behind trying these products, and whether consumers continue to buy them over time or simply try them once out of curiosity driven by the Korean cultural wave.

Source : Customer Insight

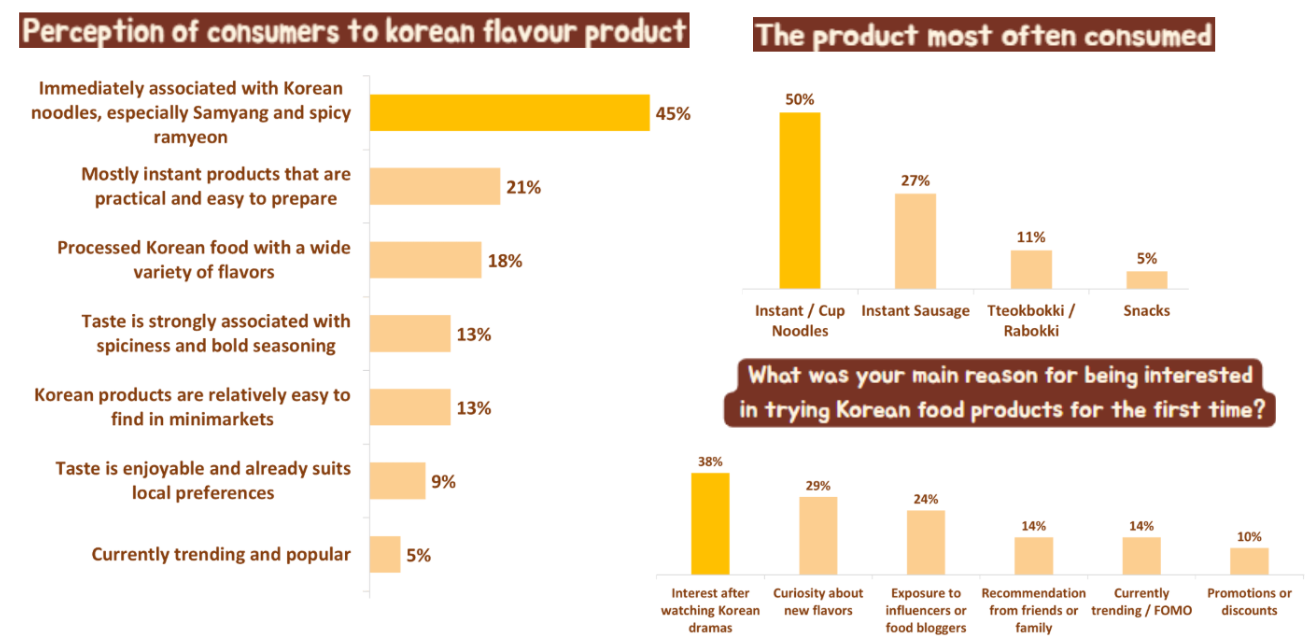

When consumers were asked to share their first impressions of Korean food products, the majority immediately mentioned Korean noodles (45%), particularly those with spicy flavors. Korean food products are generally perceived as instant, convenient, and easy to prepare.

Among these, instant noodles were the most frequently purchased at around 50% of consumers, indicating that they serve as the primary entry point for consumers into Korean-flavor food products. Consumers willingness to try Korean-flavored products for the first time was largely driven by exposure to Korean dramas, social media influencers, and curiosity about unique flavors, with approximately 38% influenced by Korean dramas.

Source : Data POS Tracking

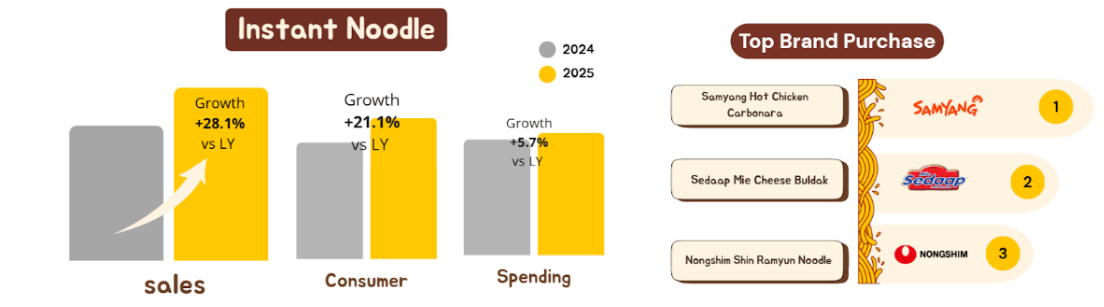

If we look at their performance, instant noodles with Korean flavors have shown a steady increase in sales. This growth is mainly driven by a rise in the number of consumers as well as higher spending per consumer.

Source : Data POS Tracking

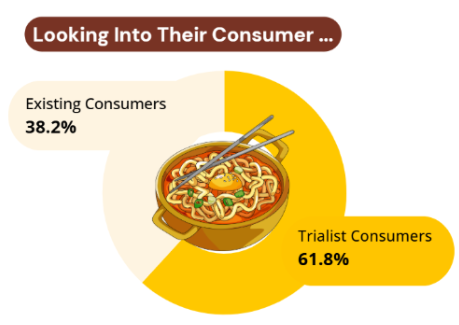

If we look further at consumers characteristics in this year, over 60% of them are trialist. Trialist consumers dominate over existing consumers, indicating that most buyers have only made a single purchase in this category

Source : Customer Insight

When we look deeper into trialist consumers, the main reasons for stopping the purchase of instant noodles with Korean-flavored variants were price and taste. Approximately 62% stated that the price was perceived as too expensive as the main reason for stopping the purchase. In addition, some consumers stopped purchasing because they felt bored with the taste or found the taste not aligned with their personal preferences. Other factors that influenced consumers decisions included the desire to save money, the perception of unhealthy products, and uncertainty about halal status.

Source : Customer Insight

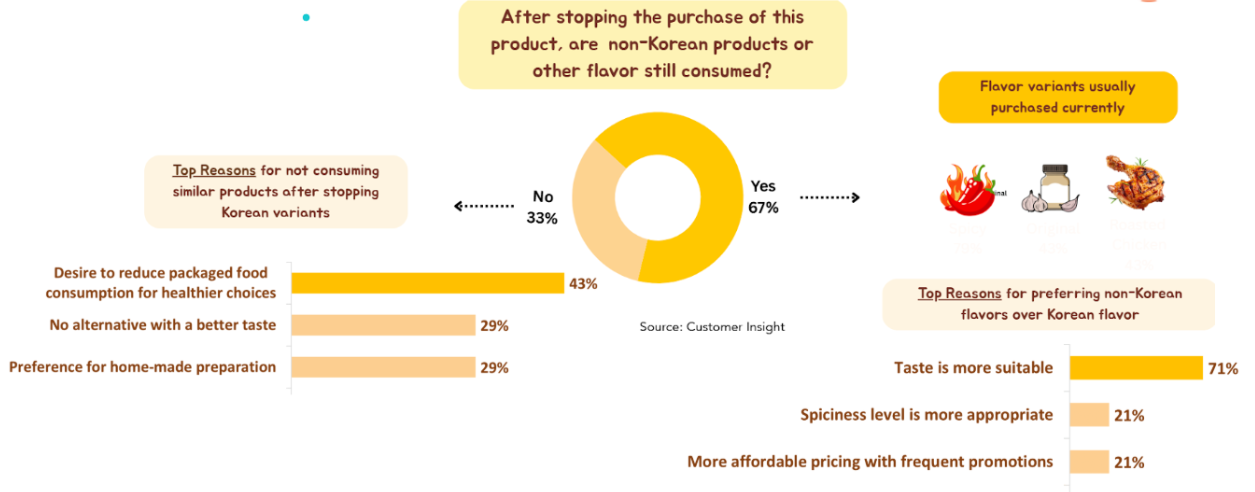

After stopping purchasing instant noodle with Korean flavor food products, consumers exhibited two distinct behavioral patterns. Some consumers, at around 67%, continued to consume similar products but switched to non-Korean flavors. The flavors currently preferred are spicy, original, and grilled chicken.

Reasons for choosing non-Korean flavors included a more enjoyable taste, a more appropriate level of spiciness, a more pleasant aroma, a variety of flavors that didn't get boring, and more affordable prices with frequent promotions.

Meanwhile, some other consumers chose to stop consuming similar products after stopping purchasing Korean flavors products. Approximately 43% consumers reasons mainly because they desire to reduce consumption of packaged products for health reasons, in addition cited included the lack of tastier substitutes, a preference for making their own food also become their reason

Source : Customer Insight

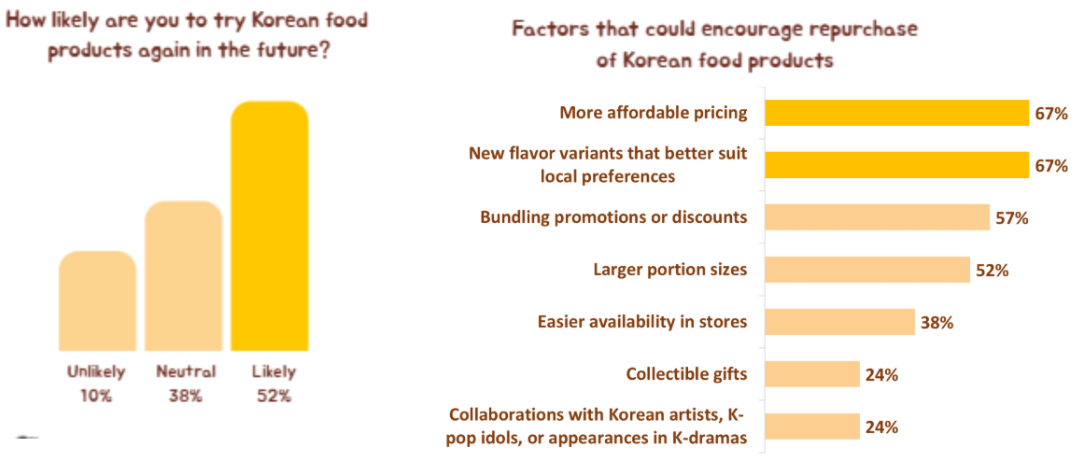

Among consumers who have stopped purchasing these products, the majority of consumers, at over 50%, still express interest in repurchasing in the future. Some consumers are in a neutral position, and only a small proportion stated that they were not interested in buying again. This repurchase intention could be strengthened if any new flavor variants better aligned with consumer preferences, more affordable pricing, and increased promotional discounts.

Source : Customer Insight

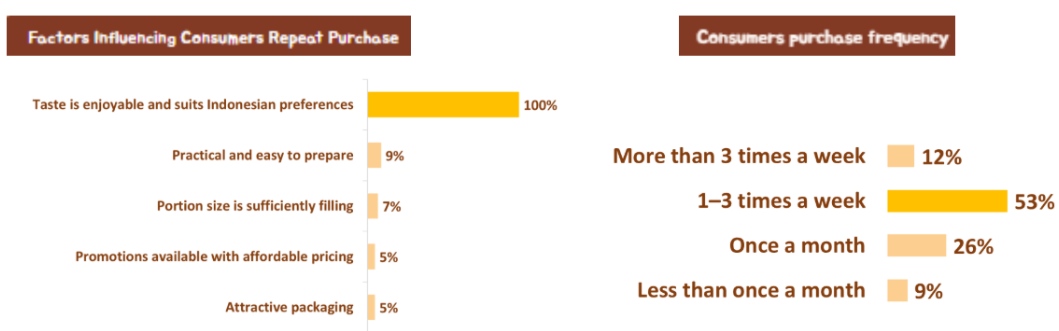

Around 60% of existing consumers continue to repurchase the products after their first purchase because they perceive the taste as enjoyable. The products have also become part of their regular purchasing pattern, with a consumption frequency of 1–3 times per week. In addition, convenience and ease of preparation further encourage repeat purchases.

Source : Customer Insight

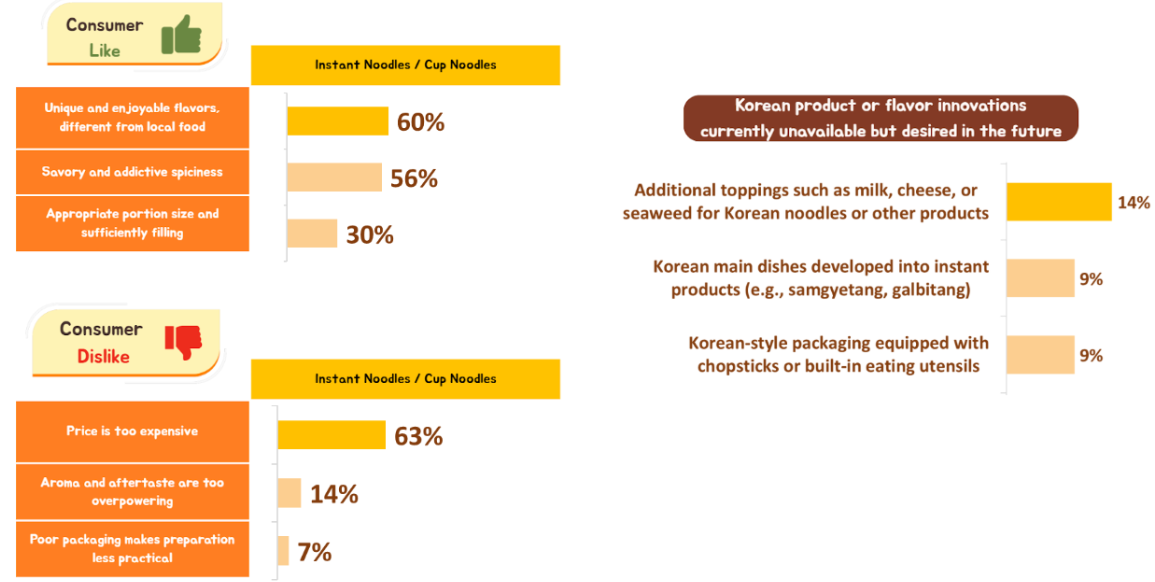

Existing consumers are attracted to instant noodle with Korean-flavored food products at around 60% because of their unique taste, which is perceived as distinct from local food, as well as their savory and spicy flavor. Appropriate portion sizes also contribute to what consumers like about these products.

However, at over 60% of consumers say that high prices are the main reason consumers dislike these products. Other aspects that consumers dislike include an overpowering aroma and aftertaste, as well as packaging that is considered less practical.

On the other hand, consumers remain interested in future products improvements, particularly the addition of toppings, the development of Korean main dishes into instant food formats, and more convenient, Korean-style packaging.

Based on these findings, Korean food products still have a market, as reflected by sales that continue to show growth. This indicates that these products are not merely tried out of curiosity, but are beginning to form sustained preferences among some consumers, including trialist consumers who still show an intention to repurchase. However, both trialist and existing consumers share a dislike toward the price aspect, which is perceived as expensive. On the other hand, differences in taste preferences indicate that Korean food does not always suit all consumers, resulting in product appeal that remains segmented.

We hope these insights and data are beneficial for you. If you want to know more about your products performance, we can help. With over 22 million members and millions of daily transactions, we provide in-depth analysis of customer behavior and products performance to support your business decisions.

(Business Analyst Alfagift/Image Doc. Photo by SenuScape on Pexels).