Tracking Instant Food Demand in 2025: Is It Still Appealing among Consumers?

In today’s modern era, speed has become a core expectation across various aspects of life, including eating habit. Instant food has emerged as a practical solution, enabling people to prepare meals quickly and easily. Given its speed and convenience, it is not surprising that instant food is expected to remain appealing to consumers and that its demand continues to grow. However, consumer lifestyles and preferences continue to evolve, meaning there is no guarantee that the appeal of instant food will persist. Therefore, data-driven tracking of instant food demand is essential to understand current consumer trends and behaviors.

In this article, we aim to track demand for instant foods in 2025 by analyzing minimarket POS (Point of Sale) transaction data and consumer survey results, in order to provide a more complete and comprehensive view of consumer trends and behavior related to instant foods.

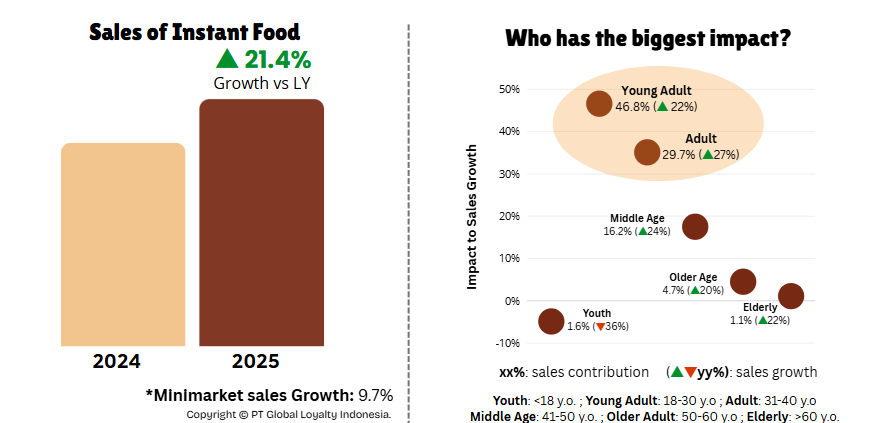

Sales of instant food in minimarkets in 2025 showed significant growth, increasing by 21.4% compared to the previous year. This figure is approximately twice the overall growth of minimarkets in the same year. This growth is mainly driven by the productive age segment (young adults and adults), which contributed the most to sales and recorded a higher increase than the overall instant food sales.

Source: Data POS Tracking

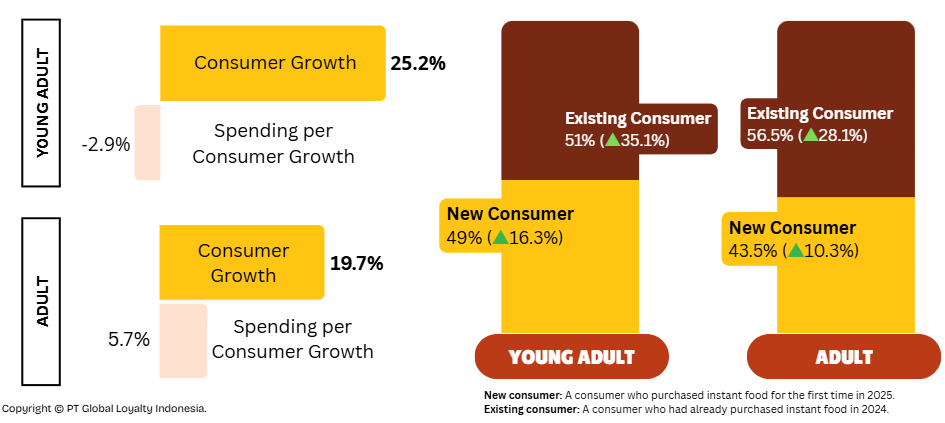

In both productive age segments, the increase in the number of consumers purchasing instant food was notable and became the key driver of sales growth. When the consumer composition was examined further by purchase period, the data showed that the proportions of existing and new consumers were relatively balanced at approximately 50:50. Both groups also displayed growth compared to the previous year. These findings confirm that instant food is not only able to retain more existing consumers but also more successful in attracting new consumers.

Source: Data POS Tracking

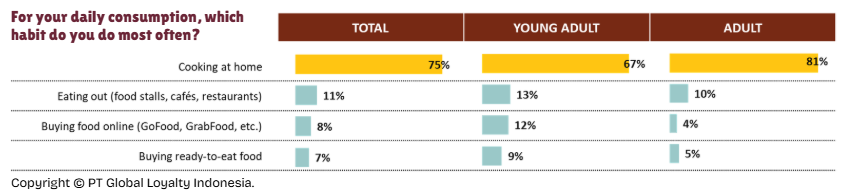

Understanding the dynamics of instant food consumption among these productive age segments becomes more comprehensive when viewed in relation to their daily consumption patterns. Most consumers eat primary foods about three times a day. Among the various ways of meeting their food needs, cooking at home is their main option.

Source: Customer Insight

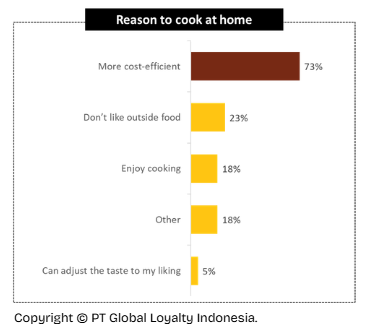

For most consumers, cooking at home is considered cheaper than buying food outside. Even so, some of them might prefer to cook at home due to their personal taste preferences.

Source: Customer Insight

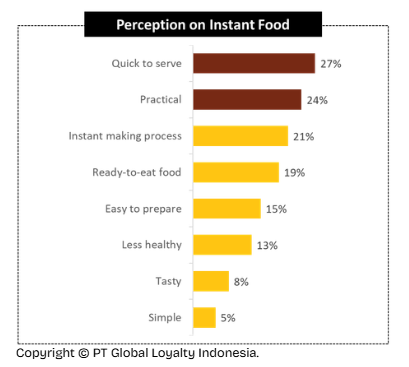

In home-cooking practices, instant food has become one of the options used by consumers. The survey shows that 100% of consumers have cooked instant food in the past three months, emphasizing its high relevance. In their perception, instant food is synonymous with food that is quick to prepare. In addition, practicality also becomes the characteristic they remember the most. However, some of them are also aware of the unhealthy effects of consuming instant foods.

Source: Customer Insight

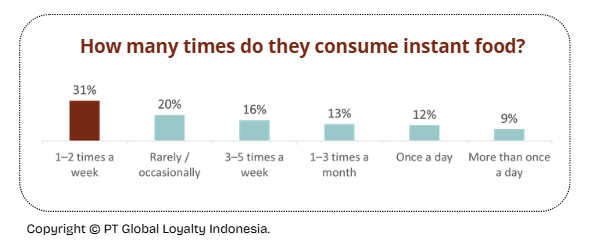

Despite that, looking at consumption frequency, many consumers eat instant food 1–2 times per week, followed by a group that consumes it occasionally.

Source: Customer Insight

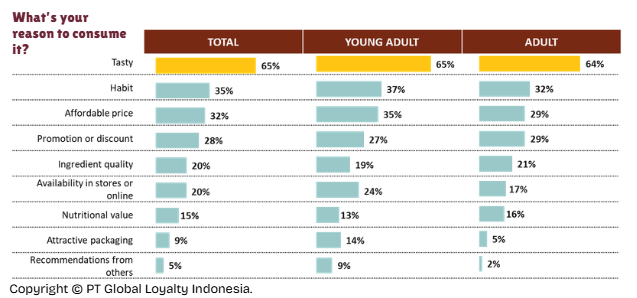

The reasons they consume instant foods vary. Among these reasons, the majority of consumers choose instant food for its delicious taste, followed by habit and price considerations. This means that it is not only a matter of convenience and practicality. Taste remains the main driving factor for consumers, both younger and older groups.

Source: Customer Insight

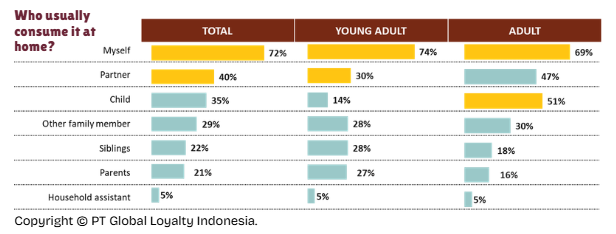

In addition to the reasons for consuming it, there are also patterns regarding who usually enjoys instant food at home besides oneself. In the older group, instant food is generally prepared for children, while in the younger group, instant food is more often prepared for partner or other family members.

Source: Customer Insight

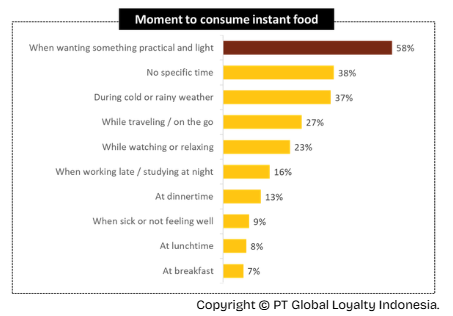

Besides these patterns, consumers also have certain moments when they choose instant food, such as when they need something light and practical or when the weather is cold or rainy.

Source: Customer Insight

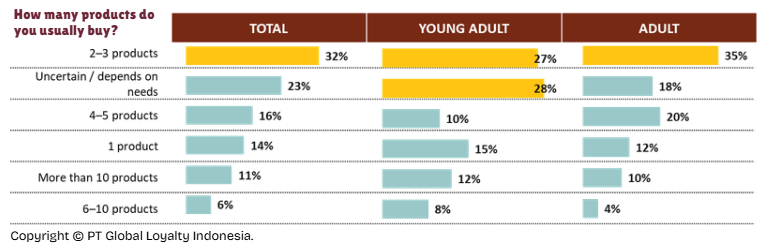

These patterns show that instant food has become a part of consumers' daily consumption. Such consistency is also evident in the intensity of purchases, with 32% of consumers buying instant foods 1–2 times per week, with an average of 2–3 products per transaction.

Source: Customer Insight

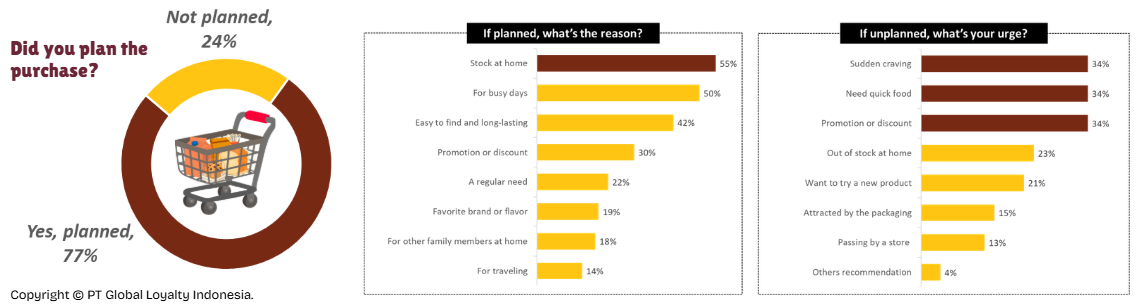

The majority of instant food purchases are planned, usually for their stock at home. Meanwhile, unplanned purchases are generally triggered by sudden cravings and the need for quick food.

Source: Customer Insight

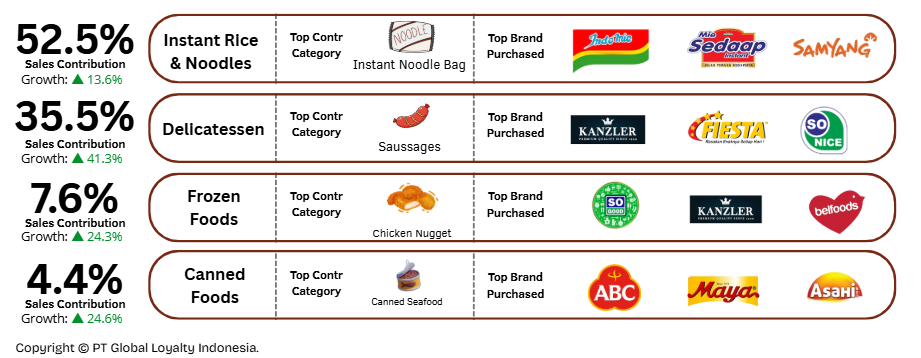

In terms of categories, instant rice and noodles emerge as the most dominant product group, driven by practicality and perceived deliciousness. On the other hand, the delicatessen category (such as sausages) stands out for having the highest sales growth, indicating an increased interest in this type of product.

Source: Data POS Tracking

Therefore, it can be concluded that demand for instant food remains significant as indicated by its solid growth in 2025, mainly driven by increased purchases among productive-age consumers. The majority of consumers still choose to cook at home and include instant foods in their regular stock. Its practicality and delicious taste help the category retaining existing consumers while also attracting new ones.

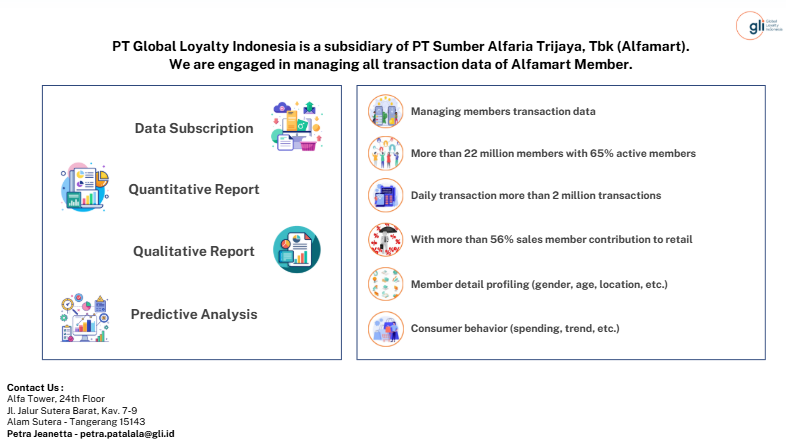

We hope these insights and data are beneficial for you. If you would like to know more about your product’s performance, we are here to help. With over 22 million members and millions of daily transactions, we can provide in-depth analysis of customer behavior and product performance to support your business decisions.

(Business Analyst Alfagift/Image Doc. Photo by Jeff Vinluan on Pexels).